In the latest installment of specialized briefings orchestrated by EMS, the Federal Trade Commission (FTC) embarked on a crucial exploration into the intricate world of scam payment methods. FTC experts delved into the ins and outs of how scammers cunningly direct their victims to make payments. This deep dive included an examination of the full spectrum of payment channels utilized by scammers, ranging from widely used apps like Venmo, CashApp, and Zelle, to more unconventional avenues such as gift cards and cryptocurrency. Shedding light on the challenges faced when attempting to recover funds lost to these scams, it became evident that the payment method itself often serves as a glaring indicator of potential fraud.

The briefing featured distinguished speakers, Sophia Siddiqui, an attorney in the Division of Marketing Practices at the Federal Trade Commission, and Lois Greisman, Associate Director at the Federal Trade Commission Division of Marketing Practices, based in Washington DC.

Lois Greisman, in her role as Associate Director of the Federal Trade Commission Division of Marketing Practices in Washington DC, set the stage by providing a sobering glimpse into the alarming prevalence of scams. The FTC continually receives an overwhelming influx of reports from consumers spanning a wide gamut of concerns, ranging from used cars to funeral services and various forms of fraudulent activities. Astonishingly, in just the first half of 2023, these reports eclipsed the one-million mark, accounting for nearly $4.5 billion in financial losses. This staggering figure, though significant, is only the tip of the iceberg, as surveys suggest that the actual number of reports and financial losses likely surpasses these recorded statistics.

The primary conduits through which scammers operate were identified as social media and telephone communication. Social media platforms, in particular, have evolved into fertile ground for scams, with scammers actively targeting unsuspecting victims in these digital landscapes. Simultaneously, the telephone remains a formidable tool for scammers, who employ fraudulent calls and unwarranted solicitations with considerable success. It’s noteworthy that telephone scams often yield high median losses per victim, underscoring their efficacy in convincing individuals to part with their hard-earned money.

Scrutinizing the preferred payment methods of scammers reveals discernible patterns. Scammers meticulously select their payment methods in alignment with the nature of their fraudulent schemes. For example, “imposter” scams frequently involve demands for payment via gift cards, typically in denominations of $100, $200, or $300. Conversely, prize and sweepstakes scams coax victims into making payments, often through gift cards or upfront payments, as a condition for claiming their purported winnings. In today’s landscape, investment scams have harnessed the surging popularity of cryptocurrency, enticing victims to transfer substantial sums in digital currency. Importantly, credit cards emerge as the safest payment option under federal law when conducting online transactions, providing a layer of protection against fraud compared to other methods.

Key takeaways from the briefing emphasized the pivotal role played by the choice of payment method as a red flag for identifying potential scams. Educating the public about the implausibility of legitimate organizations, especially government agencies, demanding payment via gift cards or wire transfers was highlighted as a critical preventive measure. These telltale signs should serve as a cautionary beacon, prompting individuals to exercise due diligence and exercise caution in their financial dealings.

Sophia Siddiqui, an attorney at the Division of Marketing Practices within the Federal Trade Commission (FTC), followed Lois Greisman’s presentation with a comprehensive exploration of payment methods and invaluable insights into recognizing scams.

The overarching message revolved around the principle that bona fide entities never insist on payment through unconventional means, such as gift cards, cryptocurrency, or wire transfers. Extreme caution is advised when encountering demands for such payment methods, particularly from unfamiliar sources, as they often serve as glaring indicators of a potential scam.

The deceptive use of gift cards by scammers, posing as prize winners and coercing victims into payment with gift cards, was underscored. A crucial reminder was issued: legitimate organizations do not require payments via gift cards. Encountering such a scenario should instantly trigger alarm bells as a likely scam.

In cases where individuals have unwittingly fallen victim to gift card scams, Sophia Siddiqui advised promptly contacting the company that issued the gift cards, such as Apple or Amazon. It is essential to retain receipts and the gift cards themselves as evidence. Furthermore, instances of gift card-related fraud can be reported on the FTC’s website at ftc.gov/giftcards.

The exponential rise of cryptocurrency’s popularity in recent years has made it an enticing target for scammers. Cryptocurrency transactions are notoriously challenging to trace, rendering recovery almost impossible. Consequently, individuals were cautioned to exercise extreme caution when confronted with promises of guaranteed profits or risk-free cryptocurrency investments. Claims of this nature are often red flags, as are celebrity endorsements and testimonials that can be fabricated to deceive.

Payment apps like Venmo were highlighted as a convenient yet potentially risky medium. To safeguard oneself, it is crucial to limit transactions on these platforms to individuals known and trusted personally. Once money is transferred through such apps, the chances of recovery diminish significantly. Similarly, wiring money directly from a bank account is a common tactic employed by scammers, especially in romance scams. The resounding advice is never to wire money to someone you don’t trust, particularly when faced with undue pressure for immediate payment.

In scenarios where individuals have succumbed to scams and made payments via credit or debit cards, Sophia Siddiqui advised reaching out to the issuing company to report a fraudulent charge and request a reversal. Credit cards, with their built-in safeguards, provide a robust mechanism for disputing charges. For alternative payment methods such as wire transfers or bank transfers, individuals were urged to contact the respective financial institution and request the charge’s reversal.

Protection against identity theft and sensitive information exposure, such as Social Security numbers, was also addressed. For those who have shared such information inadvertently, a visit to identity.gov was recommended. This platform guides individuals through the necessary steps, including credit monitoring, to mitigate potential damage. Additionally, reporting scams to the FTC at reportfraud.ftc.gov emerged as a pivotal action, aiding the FTC in building cases against scammers, tracking emerging trends, and educating the public about looming threats.

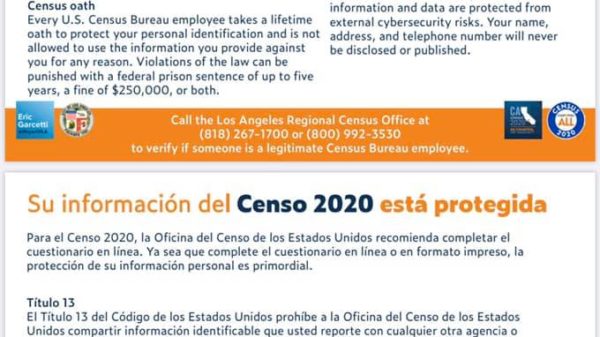

The FTC recognizes the diverse linguistic landscape of its audience, providing a wealth of resources in multiple languages. Accessible at FTC.gov/languages, these materials empower individuals from various linguistic backgrounds to spot and evade scams effectively.

In conclusion, the paramount lesson gleaned from this enlightening briefing is the critical importance of remaining vigilant and informed when it comes to financial transactions and potential scams. The presentation by FTC experts, including Lois Greisman and Sophia Siddiqui, underscored that scammers often resort to demanding payment through unconventional and high-risk methods like gift cards, cryptocurrency, or wire transfers. Recognizing these unusual payment requests should serve as a powerful warning signal to exercise caution.

Ultimately, taking swift action to protect oneself and report suspected scams is of paramount importance. Whether it’s through credit card charge disputes, contacting the appropriate authorities, or seeking assistance with identity protection, individuals have avenues to shield themselves from fraudulent activities. Furthermore, the public’s proactive reporting of scams plays a pivotal role in the FTC’s efforts to combat these threats, track evolving trends, and educate the community.

As the world of scams continues to evolve, remaining aware and informed is our best defense. This briefing served as a valuable resource to equip individuals with the knowledge and tools needed to protect themselves and others from falling victim to fraudulent schemes. By adhering to these principles and being proactive in reporting, we can collectively contribute to a safer and more secure financial landscape.