In a recent Ethnic Media Services (EMS) briefing, housing rights attorneys and mortgage experts shed light on the escalating challenges facing homeowners, particularly those from communities of color, in retaining their family homes. The catalyst for this imminent crisis is the looming exhaustion of funds from the California Mortgage Relief program, launched in December 2021 and expanded in early 2023.

The event featured key speakers, including Joe Jaramillo, Senior Attorney at Housing & Economic Rights Advocates (HERA), Rebecca Franklin, President of the California Housing Finance Agency (CalHFA), and Johanna Torres, Program Coordinator at California Rural Legal Assistance (CRLA). Additionally, two homeowners facing these threats, Saul de la Cruz and Danny Bishop, shared their personal struggles.

Challenges:

Inheritance and Probate Issues:

Joe Jaramillo highlighted the first challenge: retaining the family home when a parent or grandparent passes away, especially without a will or trust. The probate process becomes daunting, with excessive fees and accessibility barriers, putting property taxes, insurance, and mortgages at risk of non-payment.

Predatory PACE Financing:

The second threat identified was predatory Property Assessed Clean Energy (PACE) financing. This program, ostensibly for energy-efficient home improvements, puts homeowners at risk of foreclosure if the associated loans go unpaid. Salespeople aggressively market these loans, disproportionately targeting communities of color.

Resurgence of Zombie Mortgages:

The third challenge discussed was the resurgence of “zombie mortgages.” These are second loans secured by homes, often overlooked by homeowners who believed the debts were forgiven. These dormant mortgages, now resurrected, come with high interest rates and fees, posing a serious threat to affected communities.

Impact on Communities of Color:

Homeowners of color, particularly Black and Latino households, face disproportionate challenges. The pandemic exacerbated financial hardships for these households, leading to higher rates of mortgage payment delinquency and increased foreclosure risk. The three identified threats further intensify the vulnerability of these communities.

Policy Measures:

While the California Mortgage Relief Program has provided substantial aid, speakers emphasized the need for ongoing funding and renewal to address the challenges posed by the pandemic’s financial aftermath. Additionally, a pilot program was mentioned to assist homeowners affected by predatory PACE financing, offering potential relief to those struggling with property tax and mortgage payments.

The event aimed to raise awareness about the imminent threats to home ownership and empower affected communities to take preventive action. The key message emphasized the importance of policy measures, ongoing funding, and community education to mitigate the impact on vulnerable homeowners and preserve the sanctity of family homes.

Reinforcing Support:

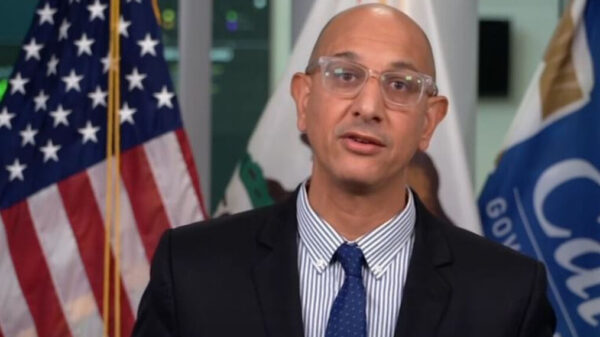

Rebecca Franklin, President of the California Mortgage Relief Program, added crucial insights to the event, emphasizing the program’s commitment to aiding homeowners facing financial hardships. Established in March 2021 through the Housing Assistance Fund, the program aims to address the specific needs of California homeowners in response to the pandemic.

Program Offerings:

Rebecca outlined the diverse ways in which the program assists homeowners in securing a fresh start. The offerings include an $80,000 grant, a distinct feature from previous relief programs, ensuring that recipients are not burdened with repayment. The program targets missed mortgage payments, property tax arrears, and offers assistance with partial claims or loan modifications entered into during the pandemic.

Encouragement to Connect:

As the program’s president, Rebecca Franklin urged homeowners to connect with the California Mortgage Relief Program, particularly if they are struggling with housing-related payments. Even if homeowners are not an immediate fit for the program, the commitment is to connect them with HUD-certified housing counselors or legal services for additional support.

Focus on Education and Support:

Rebecca highlighted the program’s dedication to educating homeowners about their options and assisting them in navigating the challenges they face. By emphasizing that the $80,000 grant is indeed real, the program aims to dispel any skepticism and encourage homeowners to seek help.

Addressing Racial Disparities:

Recognizing the disproportionate impact on certain ethnic and racial groups, the program underscores its goal of preserving generational wealth. Rebecca expressed a deep commitment to preventing homeowners, especially first-time homebuyers, from losing their homes and urged them to reach out for assistance.

Community-Based Outreach:

Acknowledging the personal nature of struggles related to homeownership, Rebecca highlighted the role of HUD-certified housing counselors and community-based organizations. These networks provide language support, education, and assistance, reinforcing the message that homeowners are not alone in their journey.

Real Solutions for Real Struggles:

Rebecca Franklin concluded by addressing the skepticism some homeowners may have about the program’s offerings. She emphasized that the California Mortgage Relief Program is a real and tangible solution for those facing genuine struggles. The program’s primary message is one of support, education, and a genuine desire to help homeowners navigate through challenging times.

Insights from Program Coordinator Johanna Torres (CRLA):

Johanna Torres, Program Coordinator at California Rural Legal Assistance (CRLA), shed light on the challenges faced by homeowners, particularly regarding the lack of clear communication from mortgage servicers about available options. She highlighted the issue of insufficient information provided to individuals, especially in cases of forbearance.

Translation of Client’s Testimony:

Senor [Client], a member of a Mexican family seeking a better life in the U.S., shared his struggle with mortgage issues. Despite facing hardships, the family invested in a home for security in Salinas, Monterey County. After obtaining two mortgages, they faced challenges with modification requests, and the second mortgage was sold to a company called Lifetime Solutions. Senor expressed confusion about the company’s actions and the absence of statements and tax information.

Concerns Raised by Senor:

Senor questioned why the company handling his mortgage did not provide statements or tax information, leading to confusion about the amount owed. He sought clarity on the situation and expressed frustration about the lack of communication from the mortgage company.

Legal Perspective and Call for Advocacy:

The program’s legal representative addressed the issue, citing laws like the Real Estate Settlement Procedures Act that mandate mortgage servicers to provide periodic statements. However, she acknowledged exceptions and proposed further advocacy to obtain necessary information and ensure transparency.

Commitment to Assistance:

The program coordinator and legal representative expressed their commitment to assisting Senor and encouraged follow-up discussions to address the specific challenges faced. They recognized the commonality of such problems and emphasized the need for advocacy against predatory practices by mortgage servicers.

Moving Forward:

The discussion transitioned to the next speaker, Mary Day, who introduced Danny Bishop, a client with a unique case, indicating the ongoing effort to bring attention to individual stories and challenges within the broader context of mortgage relief and assistance programs.

Introduction by Mary Day, Staff Attorney, HERA:

Mary Day, a Staff Attorney at HERA, welcomed the participants and introduced Danny Bishop, a HERA client. Mary emphasized her work in helping homeowners preserve their homes during times of crisis.

Background of Danny Bishop’s Case:

Mary explained that she and Danny had been working together for over a year. Danny, who lives in Richmond, advocates for his mother, facing challenges due to declining mental health. The city of Richmond initially imposed a $56,000 fine for code enforcement, leading to substantial property tax debt. California mortgage relief initially provided a maximum relief of $20,000.

Negotiations and Adjustments:

Collaborating with the city of Richmond, Mary and Danny managed to rectify the situation. The city acknowledged the error, reducing the fine to $30,000. Simultaneously, California mortgage relief increased the grant to $80,000. Danny shared that, with his family’s contribution, the total relief reached $90,000, covering the fees and fines that had caused the property tax to exceed the initial grant.

Danny Bishop’s Testimony:

Danny expressed gratitude for Mary’s assistance, highlighting how the fines and fees posed a significant threat to their home. He detailed the challenges faced in understanding the reasons behind the charges, emphasizing that without Mary’s help, saving the house would have been nearly impossible.

Family Home and Bureaucratic Challenges:

The Bishop family has lived in their house in Richmond since Danny was a child. The family faced exorbitant charges related to yard clean-up, causing financial strain. Danny shared his frustration with the lack of transparency from the authorities, making it difficult to comprehend the reasons behind the charges.

Ongoing Negotiations and Advocacy:

Mary mentioned ongoing negotiations with the city of Richmond to potentially reduce additional penalties, highlighting the financial burden placed on the family, which had to pay $10,000 out of pocket for property tax clearance.

Long-Term Homeownership and Advocacy:

Danny shared that the family had owned the house since he was four years old, emphasizing the significant emotional and familial attachment. Mary and Danny’s story highlighted the bureaucratic challenges and lack of responsiveness faced by individuals seeking clarification and relief.

Media and Community Awareness:

The conversation concluded with Mary acknowledging the importance of informative events like the one being held, shedding light on such issues and advocating for awareness in the media and communities.

The event provided a real-life perspective on the impact of fines and fees on homeowners, showcasing the role of advocacy and relief programs in preserving homes during crises.

#HomeownershipUnderSiege #MortgageReliefProgram #CommunityAdvocacy #HousingRights #PredatoryFinancing #RealEstateChallenges #RacialDisparities #CommunitySupport #LegalInsights #CaliforniaHousing #FinancialHardships #GenerationalWealth #AdvocacyInAction #HomePreservation #RealStruggles #PropertyTaxIssues #MortgageHelp #CommunityAwareness #CaliforniaHousingCrisis #HomeownershipSolutions #EquityInHousing #RealEstateNews #AdvocacySuccess #FinancialEmpowerment #HousingEquity